Amortization expense formula

Now you will notice some differences between the values of formula1 and 2. Lock Your Mortgage Rate Today.

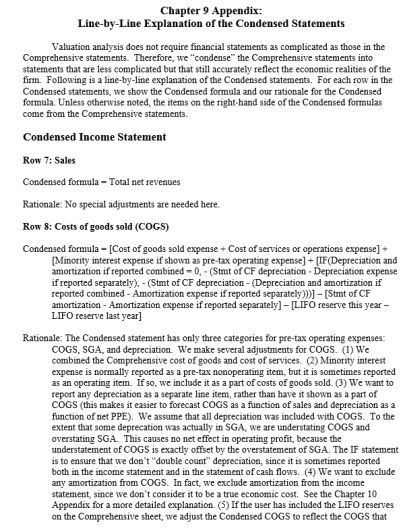

Pin On Business Iders

Vendor Name Description Amount Date Paid Start End 16-Jan 16-Feb 16-Mar 16-Apr 16-May 16-Jun 16-Jul 16-Aug 16-Sep 16-Oct.

. Alternatively InterestIPMT rate per nper pv. So EBITDA -116 325 -126 570 653 million. This is the annual amortization expense.

Record the amortization expense in the accounting records. The Depreciation formula uses the Deprecation formula to spread the assets cost over its useful life thereby reducing the huge expense burden in a single year. Here is the amortization table for the permits value.

Enter the expense formula. If the asset has no residual value simply divide the initial value by the lifespan. The result is the amount you can amortize each year.

Calculation using Formula 2. This schedule includes a calculation of all the interest and principal payments payable on a loan. Subtract that from your monthly payment to get your principal payment.

Thats your interest payment for your first monthly payment. In Expense for period 1 enter the cell reference for the period 0 liability balance and multiply by 6. Operating Profit given as 116 million and Depreciation and Amortization is 570 million.

After useful lives of an asset how much reduction has happened. Amortization expense is the write-off of an intangible asset over its expected period of use which reflects the consumption of the asset. Initial value residual value lifespan amortization expense Subtract the residual value of the asset from its original value.

Accounting for Amortization Expense Amortization is almost always calculated on a straight-line basis. EBITDA Operating Income Depreciation Amortization Operating income is a companys profit after subtracting operating expenses or the costs of running the daily. I have the following columns in my spreadsheet and would like to insert a formula that will automatically update all of the applicable months with the correct amount.

I need it to look at the start date and the date paid and calculate based on whichever date is the later date and be able to calculated the first. The cost of the permit is divided by four to get the recorded cost based on the accounting conventions. This is the cost of the fixed asset.

Operating Profit Formula Revenue from Core Operations Total Cost of Goods Sold Value Operating Expenses Depreciation Expenses Amortization Expenses Here Revenue from core operations is the total value of the amount earned by the company from the sale of the goods or provision of the services with respect to the core business operations. Since depreciation is a non-cash expense it helps entity to reduce its tax liabilities. Following are the importance of the depreciation formula in accounting.

Calculation using Formula 1. Copy the formula for expense in period 1 down for the remaining Expense rows. NPER Rate PMT PV 3.

EBITDA 116 570 686 million. Hi I am trying to create a dynamic prepaid expense amortization template with a formula that can be used for any new prepaid expenses. Fill the expense column.

The first formula is below. This write-off results in the residual asset balance declining over time. Enter 0 for expense in period 0 because payments are made in advance.

Divide the total cost of the asset by the years of each assets useful life. Multiply 150000 by 3512 to get 43750. Initial value residual value lifespan amortization expense Record amortization expenses on the income statement under a line item called depreciation and amortization Debit the amortization expense to increase the asset account and reduce revenue.

Finding interest included in EMI Interest EMI- principal 4. Here is the step by step approach for calculating Depreciation expense in the first method. This includes actual assets preparation cost set up cost taxes shipping etc.

Divide that number by the assets lifespan. What More Could You Need. Amortization Expense Assets Cost Assets Useful Life For loans the amortization formula is more complex.

Ad Were Americas Largest Mortgage Lender. The book value of the asset on the balance sheet is reduced every year by the amount of amortization. However most financial institutions and lenders provide an amortization schedule to borrowers.

Credit the intangible asset for the value of the expense. Calculating interests It is important to note that for most loans the interest charges are higher at the beginning but reduce as more payments are done. Create a journal entry at the end of the year to recognize the expense.

The general syntax of the formula is.

Myeducator Business Management Degree Accounting Education Accounting

Depreciation Vs Amortization Top 9 Amazing Differences To Learn Accounting Notes Accounting Basics Instructional Design

Times Interest Earned Formula Advantages Limitations In 2022 Accounting And Finance Financial Analysis Accounting Basics

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Loan Payment Spreadsheet Budget Spreadsheet Spreadsheet Mortgage Amortization Calculator

Ebitda Formula Accounting Education Finance Printables Saving Money Budget

Accounting Equation Chart Cheat Sheet In 2022 Accounting Payroll Accounting Accounting Basics

This Item Is Unavailable Etsy Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loans

Excel Formulas Functions For Dummies Ebook 10 Year Amortization Calculator Read This Before You Choose Your Home In Excel Formula Microsoft Excel Excel

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

Pin On Financial Education

Accelerated Depreciation Method Accounting Basics Accounting And Finance Accounting Education

Fcff Formula Examples Of Fcff With Excel Template Cash Flow Statement Excel Templates Formula

Ebit Vs Ebitda Differences Example And More Financial Modeling Bookkeeping Business Accounting Education

Ifrs 16 Transition Series For Lessees Example 2 Transitional Amortization Schedule Journal Entries